1099 nec tax calculator

Here are the steps. Any business that paid a non-employee more than 600 during the tax year is.

What Is Irs Form 1099 Misc

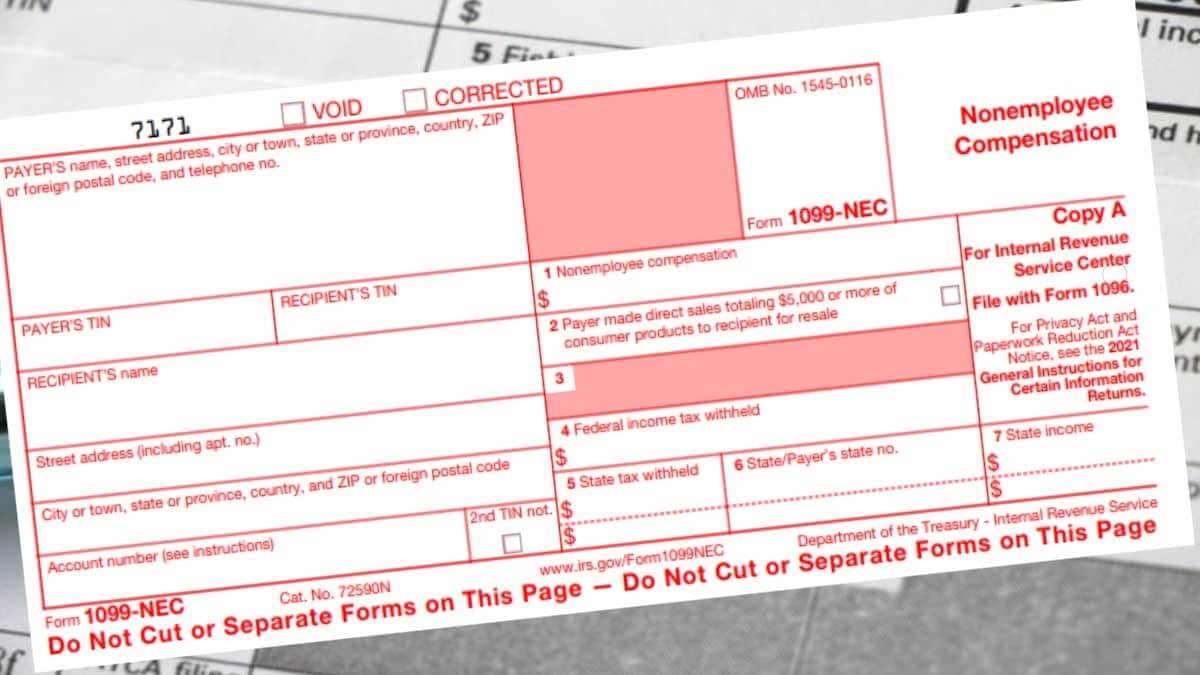

Form 1099-NEC - Nonemployee Compensation.

. Form 1099-NEC Nonemployee Compensation is used to report compensation paid to non-employees. See IRS Publications 1141 1167 and 1179 for more information about printing these tax forms. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

The 1099-NEC is the form that will be needed to report independent contractor payments for the calendar year 2020. If your 1099-NEC income is not related to self employment you can simply enter information under Other Income. For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income.

Here is how to calculate your quarterly taxes. Use Form 1099-NEC to report nonemployee compensation. Calculate your adjusted gross income from self-employment for the year.

The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used. NEC stands for Nonemployee Compensation and Form. There are five sections on the 1099-NEC.

Click Income then click Business income or loss. To the right upper corner in the search. And is based on the tax brackets of 2021.

An entry in Box 7 for nonemployee compensation would usually be reported as self-employment income on Schedule C Profit or Loss from. Use the IRSs Form 1040-ES as a worksheet to determine your. TurboTax is calculating self-employment tax and income tax on the total amount of the 1099-NEC entered.

IRS Form 1099-NEC is used to report any compensation paid to a non-employee by a business. The amount from your 1099-NEC is being taxed at your marginal income tax rate plus. It is mainly intended for residents of the US.

Current Revision Form 1099-NECPDF Skip to main content An official website of the United States Government. How to calculate your tax refund. Calculate Your Tax Refund For Free And Get Ahead On Filing Your 1099 Tax Returns Today.

All businesses must file a 1099.

Form 1099 Nec For Nonemployee Compensation H R Block

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Nec Form 2022 Printable Blank 1099 Nec Template Pdfliner

1099 Misc Form Online Filing Season Irs Forms Tax Forms 1099 Tax Form

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Nec Form 2022 Printable Blank 1099 Nec Template Pdfliner

How To Know How Many Stamps To Use Forever Stamps Stamp How To Know

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

1099 Forms For Property Management Everything You Need To Know 2021 Update Buildium

Who Should Get A 1099 Nec Small Business Finance Coaching Business Financial Information

1099 Nec Software To Create Print E File Irs Form 1099 Nec

Irs Form 1099 Nec Instructions How To Fill It Out Tipalti

1099 Forms For Property Management Everything You Need To Know 2021 Update Buildium

If You Don T Get Form 1099 Is It Taxable Will Irs Know Hint If A Tree Falls In The Forest

Form 1099 Nec Instructions 2022

Freelancers Meet The New Form 1099 Nec

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor